Zambia is said to be one of the 20 poorest countries in the world. Taken in mind that the country exports copper worth millions, if not billions, of US dollars, this is difficult to understand. But when we consider that from 2001 until 2008 the copper prices have increased by nearly 400% but the taxes that the mining companies have paid to the Zambian government have not changed, we have one reason why Zambia doesn't gain the profit from the copper expert that it deserves. In the documentary 'Stealing Africa, Why Poverty' (you find it in Highlights on the home page) Nicolas Shaxson explains how prices of minerals are manipulated by mining companies, resulting in impropriate tax profits for the exporting countries. The documentary shows Vice President Guy Scott touring the country to find how the mining companies react on questions concerning payment of taxes, their attitude towards the welfare of the communities, the working conditions of their employees and their care for the environment. He returns disappointed to Lusaka. President Sata makes the following statement: "Mining companies export copper and we don't know what they're doing with our money. If they're exporting our minerals, the money must come back to Zambia".

We wish the Zambian Government good luck in tackling this issue. Finance Minister N'gandu Magande seems to make a move by mentioning that 'multinational companies avoid taxes by inflating their operational costs through the involvement of many foreign firms in transactions'. The firm he mentions is not a mining company however, but Zambia Sugar Plc.

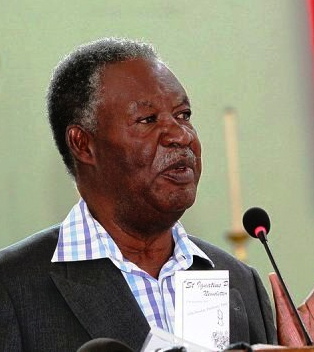

Finance Minister N'gandu Makande

Finance Minister N'gandu Makande

Finance Minister N'gandu Magande explains how multinationals avoid taxes

by Gift Chanda

MULTINATIONAL companies are avoiding taxes by inflating their operational costs through the involvement of many foreign firms in transactions, says Ng'andu Magande.

Meanwhile, Zambia Sugar has denied engaging in illegal practices aimed at reducing the amount of taxes paid to the Zambian Treasury.

Commenting on revelations by the British charity ActionAid that accused Zambia Sugar Plc of avoiding paying taxes enough to put 48,000 children in school annually in Zambia, Magande said the involvement of too many companies in the operational chains of multinational companies was inflating costs and eroding their tax obligation to Zambia.

Magande, who is Zambia's longest-serving finance minister, says tax avoidance by foreign multinational firms operating in the country was widespread.

According to the Zambian law, companies only become liable to pay company tax when they become profitable and have subtracted their operational costs from their total revenues.

ActionAid claimed that Zambia Sugar had paid "virtually no corporate tax in Zambia since 2007".

Its report released on Sunday revealed that Zambia Sugar Plc moved millions of kwacha out of Zambia and into tax havens like Mauritius and the Netherlands, reducing its taxable profits.

The company, which generated profits of KR550 million, was accused of "siphoning" over KR374 million out of Zambia and paying only 0.5 per cent of its pre-tax profits.

But Zambia Sugar, in a statement issued yesterday, insisted that there was no artificial reduction in profit in Zambia.

"Zambia Sugar payments made by Zambia Sugar for the services of third party contractors, expatriate personnel in Zambia and export services provided by Illovo, are made at cost," the company stated.

"We have responded in a transparent and detailed manner to ActionAid and despite this they have produced a report written in inflammatory language that is designed to mislead."

But ActionAid insisted during a public discussion forum in Lusaka yesterday that the report was factual and represented what was on the ground.

ActionAid country director for Zambia said the organisation had since lobbied people to go on a one-week sugar-free campaign to compel Zambia Sugar to start paying its taxes in the country.

And Magande, who is also Movement for National Progress president, said local people needed to benefit from the incomes made from their resources.

"If you read this report, how many companies will you find involved in just selling your sugar to Burundi, which is just on the boundary of Zambia? Do you need all these companies in Mauritius, in Ireland to be involved? You see, by having all these intermediaries, they multinationals are just adding the costs and those costs go on the accounts of the Zambia Sugar company," he said in an interview.

"When that happens, Zambia Sugar is going to pay more money for just moving one tonne of sugar to an importer in Burundi and in that way, they are inflating their costs of production and, therefore, their taxable income goes down."

Magande said once the taxable income goes down, the company will pay less tax.

"We are not saying this is illegal, we are not saying it doesn't happen, but what we are questioning is that 'does it need to happen?'

No! You cannot have more cost on producing one tonne of sugar from Nakambala, with the factory in the fields and probably the furthest point to the sugar canes is only about 10km. The sugar is packed locally, why do they need somebody from Mauritius to say this is from Zambia? These are things that are happening but should we allow them to continue because they reducing the taxable income?" he asked.

Magande further said the management fees the firm pays for services sought out of Zambia could be avoided because there is capacity locally.

Meanwhile, University of Zambia lecturer Dr Mathias Mpande says any deliberate act inimical to the country's treasury should be stopped because it is not morally right.

He said multinational firms must declare correct and equitable taxes to the government.

Dr Mpande also advised the government to avoid creating different tax arrangements with various firms, saying this was breeding revenue leakages.

And NAREP president Elias Chipimo said the government should be ready to revoke incentives given to firms that set up their accounting systems in ways that make them pay less tax.

"There shouldn't be any secrecy around development agreements at all," said Chipimo in an interview. "They should be made public. In fact, the government should have made these agreements public in the first place."